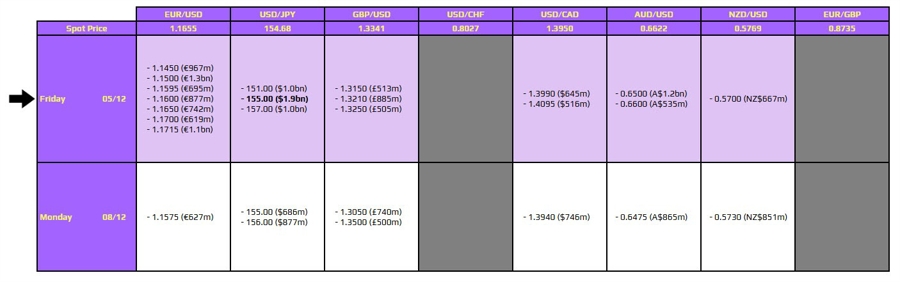

The foreign exchange market is closely observing the expiry of options for USD/JPY at the 155.00 level on December 5, 2023. This significant threshold has become a focal point for traders, particularly after sellers attempted to push the pair below this mark yesterday but ultimately failed, closing at 155.05. As a result, market participants are bracing for another attempt to breach this level today.

The expiries at the 155.00 mark may impose a ceiling on price movements, particularly as the US dollar remains relatively weak and the Japanese yen benefits from more hawkish expectations ahead of the upcoming meeting of the Bank of Japan (BOJ) later this month. Traders should pay close attention to the technical indicators as the week progresses, specifically watching for a potential daily or weekly close below 155.00. Such a development could exert additional downward pressure on the USD/JPY pair in the following week.

Market Dynamics and Expectations

The dynamics of the market leading up to the expiry indicate that the sellers will need to renew their efforts to secure a break below the critical level. A sustained close under 155.00 could signal a shift in momentum, prompting traders to reevaluate their strategies.

The situation is particularly fluid, as market conditions can change rapidly based on trading flows leading up to the expiry time. As noted, fluctuations in the dollar’s strength and the yen’s trajectory will play crucial roles in determining the pair’s direction.

For those looking to stay updated on the latest developments, it is worth noting that Giuseppe will cover the expiries during the author’s absence until December 16. Traders are encouraged to check in for further updates and insights. Additionally, detailed guidance on utilizing this data is available through ForexLive, ensuring that traders can navigate the complexities of the market effectively.

As the market prepares for the expiries, it is essential to keep in mind that these levels are subject to change. The ongoing interplay of economic indicators, trader sentiment, and technical analysis will shape the outcomes for USD/JPY as we move closer to the expiry date.