The Trump administration has intensified its efforts to combat alleged fraud in federal safety net programs, spurred by a controversial video from a conservative creator in Minnesota. The administration has frozen all federal child care payments to the state and rescinded a Biden-era rule that it claims facilitated fraud, despite investigations revealing no evidence of wrongdoing by child care centers. This action is part of a broader strategy that includes auditing Medicaid billing and freezing funds in five Democrat-led states. Vice President JD Vance announced plans to appoint an assistant attorney general specifically focused on investigating and prosecuting fraud.

The administration’s actions come amid ongoing claims of fraud in various federal programs such as food stamps, Medicaid, and the Affordable Care Act. Historically, concerns regarding waste and fraud have been prevalent in Republican discourse, but the Trump administration has elevated these issues as a justification for significant program changes. Critics argue that many of the administration’s claims are overstated or inaccurate.

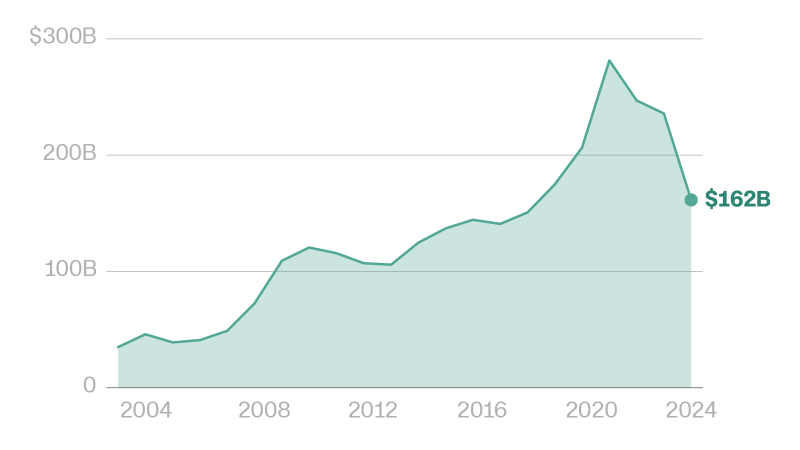

According to a report by the Government Accountability Office (GAO), between $233 billion and $521 billion could be lost to fraud annually across federal programs, amounting to approximately 3% to 7% of average federal obligations. The GAO’s findings are troubling, yet they also highlight that not all improper payments are fraudulent; many result from administrative errors. In fiscal year 2024, the federal government reported $162 billion in improper payments across 68 programs, with the majority attributable to overpayments.

The COVID-19 pandemic exacerbated these issues, as relief programs attracted criminal activity due to relaxed oversight measures. Linda Miller, founder of the nonprofit Program Integrity Alliance, emphasized the sophistication of fraud actors during the pandemic, noting that agencies were expected to learn from these experiences. Despite ongoing vulnerabilities, many of the issues highlighted by the GAO remain unaddressed due to concerns over costs, outdated technology, and privacy issues.

The Trump administration has proposed measures to enhance data sharing among federal agencies and between federal and state governments to identify and eliminate fraud. While some experts advocate for increased verification requirements for federal benefits, they also caution against the potential privacy implications of such measures. Matt Weidinger, a senior fellow at the conservative American Enterprise Institute, supports the use of technology to improve payment accuracy, arguing that the risks of data sharing are outweighed by the necessity of preventing fraud.

Fraudulent activities in federal programs often stem from organized crime rather than individual beneficiaries seeking to exploit the system. Miller noted the lack of understanding regarding the role of transnational crime groups in these fraudulent schemes. This context complicates the narrative that fraud is primarily driven by individual misconduct.

The Trump administration has highlighted specific instances of fraud to underscore the need for reform. For example, during a recent cabinet meeting, Agriculture Secretary Brooke Rollins reported that 186,000 deceased individuals’ Social Security numbers were used to collect benefits from the Supplemental Nutrition Assistance Program (SNAP). The USDA estimates that approximately $24 million per day is lost to undetected fraud and errors, emphasizing the urgency of addressing these discrepancies.

In the realm of Medicaid, the Centers for Medicare and Medicaid Services (CMS) has identified significant issues related to improper enrollment. As of July 2024, 2.8 million people were enrolled in Medicaid or the Children’s Health Insurance Program across multiple states, leading to duplicate coverage and unnecessary expenditures. The GAO has also found alarming instances of fraud where fictitious applicants were approved for subsidies under the Affordable Care Act.

The administration’s efforts to mitigate fraud extend to the Social Security Administration, where officials have sought greater access to databases to identify fraudulent claims. New measures, including in-person verification for certain beneficiaries, aim to tighten security, although some initiatives faced backlash and were ultimately rescinded.

In the child care sector, the Department of Health and Human Services (HHS) reported that an estimated 3.6% of payments from the Child Care and Development Fund were improper in 2023. In response to potential fraud, HHS has frozen payments and rescinded a rule that allowed states more flexibility in administering funds. Critics, including former HHS officials, argue that the administration’s rationale for these changes is misguided and that they undermine support for families and child care providers.

The Trump administration’s focus on fraud in federal programs reflects a broader policy objective to overhaul safety net programs amid claims of misuse. While addressing fraud is essential, the implications of these policies on vulnerable populations remain a point of contention, as advocates call for a balanced approach that does not sacrifice essential support for families.