The Fidelity MSCI Health Care Index ETF (NYSEARCA:FHLC) is now under scrutiny as investors evaluate its potential amidst a fluctuating market. With an expense ratio of just 0.084%, FHLC offers a low-cost entry into the healthcare sector. However, it carries a significant concentration risk, with over 13% of its portfolio tied to Eli Lilly, a stock that has seen a remarkable 46% rise in the past year.

Healthcare investing is often seen as a defensive strategy, particularly during periods of market turbulence. Yet, it is not without its challenges. Regulatory uncertainty and political risks can lead to sudden sell-offs, leaving investors to weigh the pros and cons of funds like FHLC.

Analyzing FHLC’s Performance and Risks

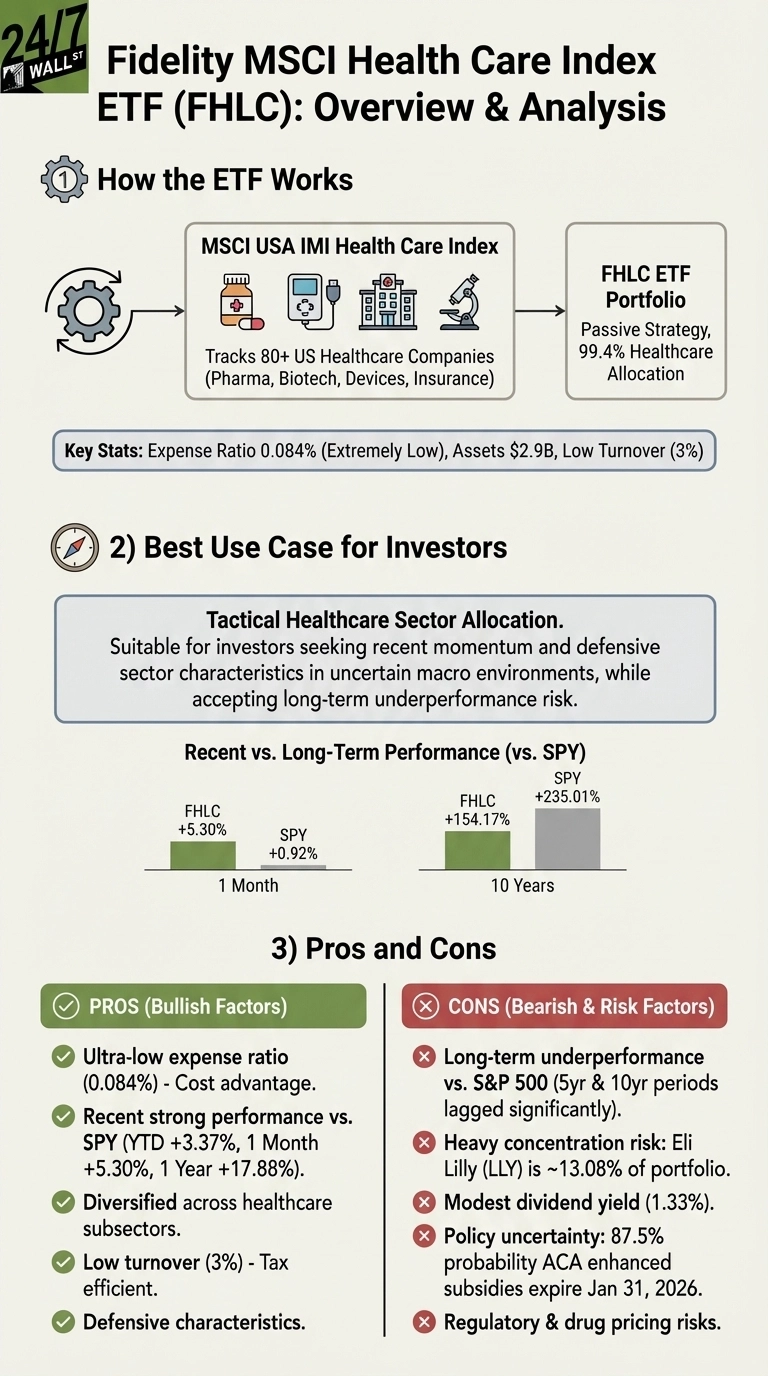

FHLC tracks the MSCI USA IMI Health Care Index, providing exposure to a diverse range of U.S. healthcare companies, including pharmaceuticals, biotechnology, medical devices, and health insurance. The fund boasts over 80 holdings, aiming for capital appreciation and modest dividend income.

Despite its short-term performance, which includes a 17.9% return over the past year, the long-term picture is less favorable. Over the past five years, FHLC has returned only 42.6%, compared to the S&P 500’s impressive 84.5%. The disparity widens further over a ten-year horizon, with FHLC yielding 154% versus the S&P 500’s 235%. This underperformance reflects ongoing challenges within the healthcare sector, such as drug pricing pressures and slower innovation cycles.

Investors should also note that while FHLC has performed well recently, buying after a period of outperformance carries inherent risks. The fund’s reliance on Eli Lilly amplifies this concern, as a significant decline in this stock could adversely impact FHLC’s overall returns.

Income Potential and Political Uncertainty

Investors in the healthcare sector must also navigate political and regulatory uncertainties. Current prediction markets indicate an 87.5% probability that enhanced ACA premium tax credits will expire by January 31, 2026. Such developments could place pressure on health insurers like UnitedHealth, which constitutes 4.5% of FHLC and has already seen a 31% drop in value over the past year.

For income-focused investors, FHLC’s yield of 1.33% may not meet expectations compared to broader market alternatives. Although the fund has increased dividends at an annual rate of 4.6% over the past five years, this barely keeps pace with inflation and falls short of the income potential offered by other defensive sectors.

For those seeking maximum capital appreciation, FHLC may not be the best fit. Its long-term underperformance compared to the broader market suggests that growth-focused investors might find better opportunities elsewhere. Similarly, retirees prioritizing income generation are likely to find superior yields in other sectors without sacrificing stability.

An alternative worth considering is the Vanguard Health Care ETF (NYSEARCA:VHT), which charges a slightly higher expense ratio of 0.09% but offers a larger asset base of $20.4 billion compared to FHLC’s $2.9 billion. VHT provides better liquidity and tighter bid-ask spreads, along with a marginally higher dividend yield of 1.38%.

While FHLC can serve as a tactical allocation for investors seeking low-cost exposure, the significant concentration risk and historical underperformance necessitate careful consideration and position sizing. As always, understanding the broader market context and individual investment goals is crucial for making informed decisions in this complex sector.