Former President Donald Trump has set a deadline of January 20, 2024, for credit card companies to implement a 10% interest rate cap. While the demand has garnered attention, the White House has not provided details on potential consequences for companies that fail to comply. This lack of clarity has left consumer groups, politicians, and bankers questioning the administration’s plans and intentions.

Despite the uncertainty, the White House has emphasized research suggesting that capping interest rates could save American consumers approximately $100 billion annually in interest payments. According to a study conducted during Trump’s 2024 presidential campaign, while the credit card industry would face significant impacts, it would remain profitable, though credit card rewards and perks might be reduced.

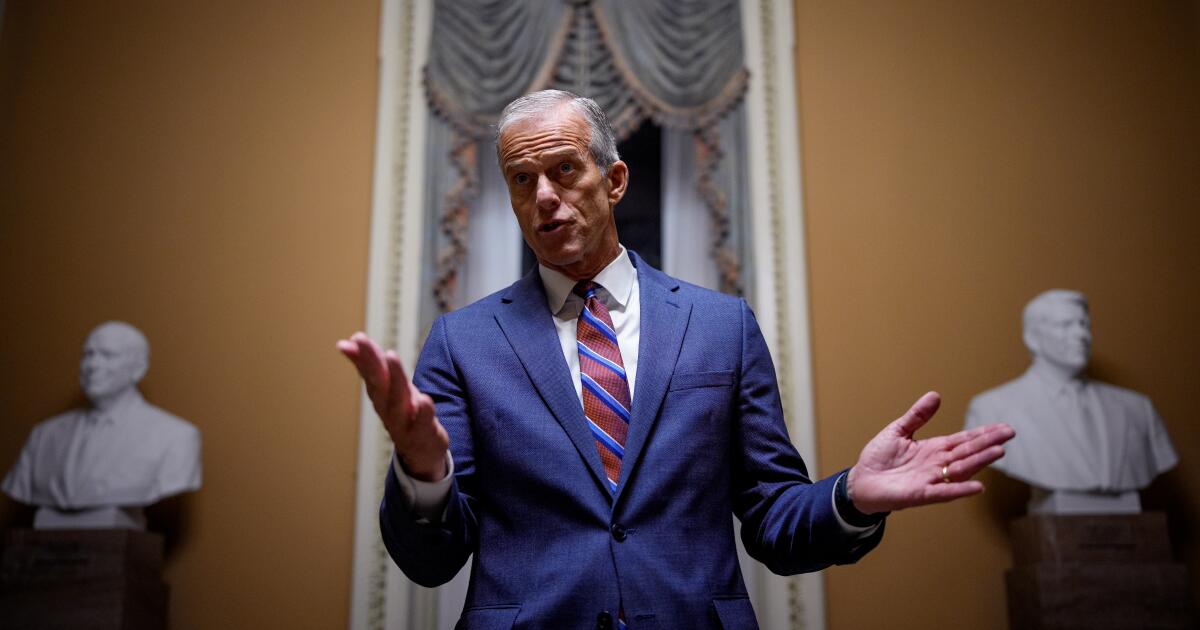

White House Press Secretary Karoline Leavitt stated that the president has “an expectation” that credit card companies will adhere to his demand. She remarked, “I don’t have a specific consequence to outline for you but certainly this is an expectation and frankly a demand that the president has made.”

Bank lobbyists are currently grappling with the administration’s lack of communication regarding how the proposed cap will be enforced. Historically, legislative efforts to impose interest rate caps have faced opposition in Congress. The Dodd-Frank Act, enacted after the 2008 financial crisis, restricts federal regulators from setting usury limits on loans. Without a formal law or executive order, it appears that Trump may depend on political pressure to influence the credit card industry’s actions, similar to his previous demands of the pharmaceutical and technology sectors.

As the deadline approaches, leading banks are voicing their apprehensions. In a recent call with reporters, JPMorgan Chase‘s Chief Financial Officer Jeffrey Barnum indicated that the industry is prepared to resist any efforts to implement the cap. JPMorgan, a significant player in the credit card market with customers holding a collective balance of $239.4 billion, has partnerships with major companies like United Airlines and Amazon.

Conversely, Mark Mason, Chief Financial Officer of Citigroup, expressed that while they oppose the cap, the bank is open to collaborating with the administration on solutions to improve affordability for consumers. He warned that a cap could restrict credit access and have detrimental effects on the economy.

In a strategic move, Trump also endorsed a congressional bill that could affect the revenue banks earn from merchants each time a customer uses a credit card. This additional pressure on the credit card industry comes as Bilt, a financial technology company, recently introduced a new credit card offering that caps interest rates at 10% on new purchases for a year. Bilt’s CEO, Ankur Jain, stated, “If this is going to happen, we’d rather be at the forefront.”

While the holiday season has concluded, consumer credit card statements are expected to rise, leading financial experts to provide guidance on managing post-holiday debt. As discussions continue, the implications of Trump’s demand for a 10% interest rate cap could reshape the financial landscape, but the path forward remains unclear for both consumers and the banking industry.