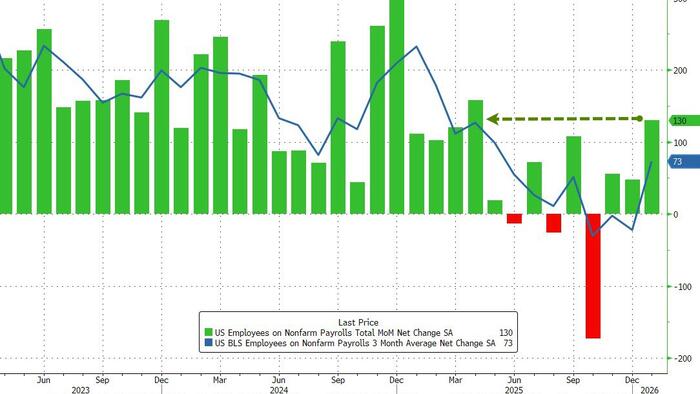

The U.S. labor market exhibited unexpected resilience in January 2025, adding 130,000 jobs, more than double the 65,000 median estimate by economists. This surge marks the most substantial monthly increase since December 2024, surprising market analysts who had anticipated disappointing figures.

Prior to the report’s release, officials from the Trump administration, including Peter Navarro and Kevin Hassett, cautioned against high expectations, suggesting a potential weak performance. Navarro emphasized the need to “revise our expectations down significantly,” while Hassett advised not to panic if the labor data fell short. These warnings set a low bar, with some projections anticipating a mere 35,000 jobs added.

Despite the gloomy forecasts, the announcement from the U.S. Bureau of Labor Statistics (BLS) revealed a stronger-than-expected job gain. This figure is particularly noteworthy as it surpasses 79 out of 80 forecasts, with only Citigroup’s estimate of 135,000 being higher. The December figures were also revised down from 50,000 to 48,000, reflecting a downward trend in previous reports, where 25 of the last 26 had been revised lower.

Unemployment Rate Declines Amid Job Growth

In addition to job creation, the unemployment rate unexpectedly fell to 4.3%, down from 4.4% in December, which had been expected to remain stable. The jobless rates for various demographic groups improved as well: teenagers experienced a decrease to 13.6%, while adult men, women, and various ethnic groups saw modest gains.

The labor force participation rate also showed improvement, rising to 62.5% from 62.4%. Furthermore, hourly earnings increased by 0.4% month-on-month, surpassing the revised 0.1% gain in December and exceeding the 0.3% estimate. Year-on-year, average hourly earnings rose by 3.7%, consistent with projections and unchanged from the previous month.

The report detailed other significant trends, including a decrease in the number of individuals employed part-time for economic reasons, which fell by 453,000 to 4.9 million. However, this number remains 410,000 higher than the previous year. The count of individuals not in the labor force but wanting a job decreased by 399,000 to 5.8 million, indicating a slight tightening in the labor market.

Sector-Specific Job Gains and Losses

The establishment survey highlighted job growth primarily in the health care and construction sectors. Health care added 82,000 jobs, with notable increases in ambulatory health care services and hospitals. Social assistance jobs also grew by 42,000, while construction saw a gain of 33,000 jobs.

Conversely, federal government employment continued its downward trend, losing 34,000 jobs in January. Since peaking in October 2024, federal employment has decreased by 327,000, or 10.9%. Financial activities also saw declines, with 22,000 jobs lost in January, reflecting a broader contraction in this sector.

Despite the positive headlines, concerns linger regarding the accuracy of the reported job numbers. The establishment survey was re-benchmarked to align with comprehensive payroll job counts from March 2025, leading to substantial downward revisions. The seasonally adjusted total nonfarm employment level for March 2025 was revised downward by 898,000, indicating that the U.S. economy generated significantly fewer jobs than previously reported.

As the labor market continues to evolve, analysts suggest that the Federal Reserve may need to consider aggressive rate cuts to mitigate the risks associated with a potentially contracting labor market. The January figures, while initially promising, could face substantial revision in the months ahead, highlighting the complex dynamics of the U.S. employment landscape.