The integration of artificial intelligence (AI) in healthcare and biopharma sectors is reshaping the insurance landscape, presenting both risks and opportunities for underwriters. As companies increasingly adopt AI technologies, insurers must adapt to the evolving needs of the life sciences industry. This transformation is particularly evident in areas such as clinical trials and the development of precision medicine.

The emergence of precision medicine has significantly improved disease detection and treatment. By identifying biomarkers and genes linked to specific illnesses, medical professionals can tailor therapies to individual patients. With AI applications enhancing research and development processes, earlier interventions and refined diagnostics are becoming commonplace. This shift not only improves patient outcomes but also has the potential to extend human lifespans.

Jim Craig, Senior Vice President – Underwriting at Munich Re Specialty in North America, has over 25 years of experience in life science liability underwriting. He recently established the company’s life science liability division. In his role, Craig discusses how AI adoption is influencing life sciences and what companies should consider to manage associated risks effectively.

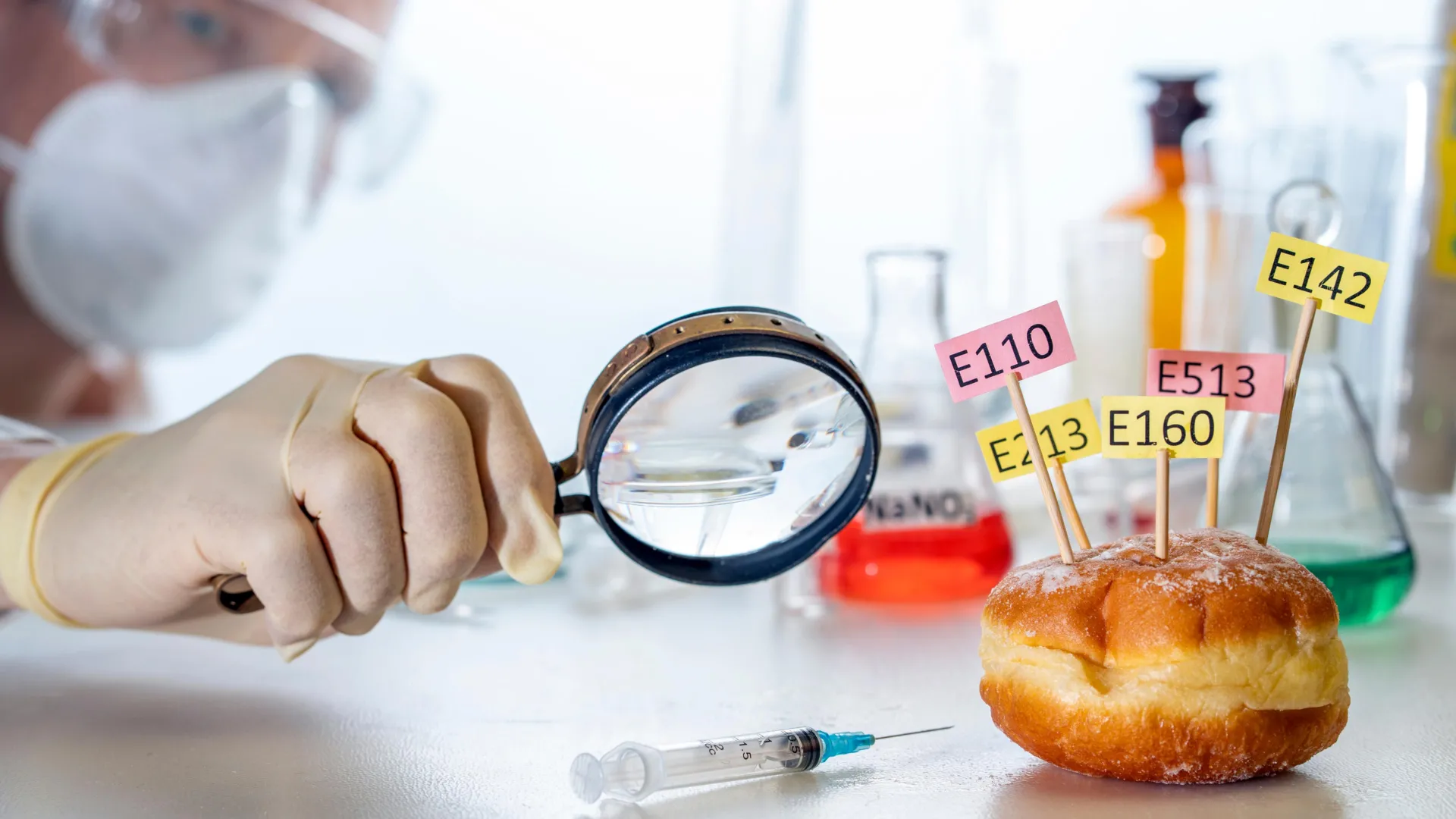

Munich Re Specialty provides coverage for various sectors, including branded and generic pharmaceuticals, clinical trial sponsors, medical device manufacturers, and dietary supplement producers. According to Craig, the use of AI is revolutionizing risk assessment in the life sciences sector. He stated, “Data is becoming an increasingly rich resource. In areas where this data is accessible, risk selection will become a lot more accurate and sophisticated, while providing the opportunity to tailor insurance solutions to meet the complex challenges faced by life science organizations.”

AI’s impact is particularly notable in the recruitment and selection of participants for clinical trials. By analyzing Electronic Medical Records (EMR), AI can streamline the identification of suitable candidates for trials, which is often a major challenge for biotech companies. Craig highlighted that many drug developers struggle to meet participant recruitment targets, leading to over-insurance or delayed timelines. AI can address these issues by enabling quicker identification of appropriate participants.

Moreover, AI algorithms have shown promise in therapeutic ingredient selection, analyzing vast datasets to identify effective anti-cancer compounds and predict their efficacy in new drugs. They can also assess medical images with a diagnostic accuracy comparable to that of expert radiologists, further enhancing the capabilities of healthcare providers.

Despite the advantages, Craig pointed out that there are challenges in AI application within life sciences. As the health tech landscape evolves, securing the correct insurance coverage remains critical. Coverage options include product liability for bodily injury or property damage during clinical trials, cyber liability to cover cybersecurity incidents, and errors and omissions liability to protect against negligence that could result in financial loss for clients.

Craig elaborated on the importance of specific coverages, saying, “Errors and omissions liability would come into play when an organization conducts work for others and their negligence in that work could lead their customer to suffer a financial loss.” For complex products, such as medical devices that involve direct interaction with healthcare professionals, medical malpractice liability coverage becomes essential in case of product or practitioner failure.

Munich Re’s product, aiSure™, addresses the risks associated with AI model errors, including those caused by generative AI systems that may lead to significant revenue losses. This coverage also accounts for business interruptions and legal issues stemming from AI-related errors. Craig emphasized that “hallucination risk is top of mind for a lot of the clients that we would serve.”

In a sector characterized by rapid growth and various players, Munich Re Specialty differentiates itself through its dedicated life science liability underwriting unit. The company is committed to long-term growth, backed by a solid reputation and financial strength to cover claims. Craig noted the advantage of having a collaborative environment within the healthcare unit, which facilitates policy discussions and claim management.

As AI continues to reshape the life science industry, it opens up numerous opportunities for small to medium-sized companies to enhance drug development processes and improve patient outcomes. Navigating these risks and securing appropriate insurance coverage is vital for organizations looking to harness the potential of AI in healthcare.

In conclusion, the application of AI in the life sciences sector is not only advancing medical research but also prompting a reevaluation of insurance needs. By understanding these changes, companies can better position themselves to leverage the benefits of AI while managing the risks involved.