UPDATE: California consumers are pulling back from major purchases, with new reports revealing a significant decline in both home and vehicle sales for 2025. This trend signals deepening economic anxiety among residents amid rising prices and stagnant wages.

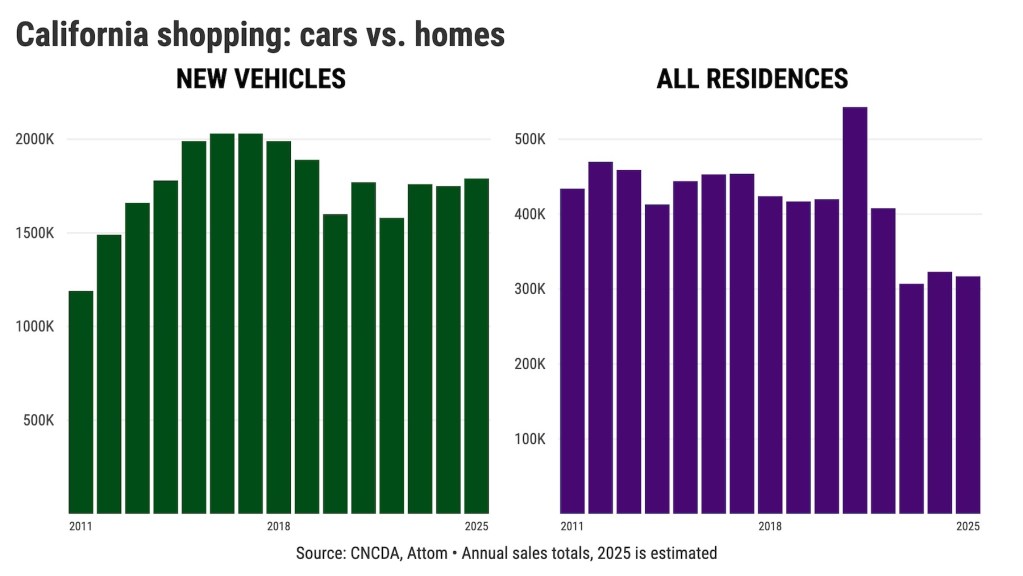

According to the California New Car Dealer Association, sales of new vehicles are projected to reach 1.79 million in 2025, marking only a 2% increase from 2024, following a 1% decline. Meanwhile, the real estate tracker Attom reports that home purchases are expected to fall to 317,000, a decrease of 2% from last year after a 5% rise in 2024.

This reluctance to spend on significant investments is troubling. As economic stability fades, consumer confidence in California has plummeted, influenced by the fallout from the Trump administration’s policies and ongoing inflation, which continues to erode household budgets.

The average price of a new car has surged past $50,000, while interest rates compound the burden on buyers. As of mid-2025, the Federal Reserve reports that the average rate for a five-year car loan stands at 7.9%, a sharp increase from 4.5% in 2022. Similarly, Freddie Mac confirms that the rate for a 30-year mortgage has climbed to 6.8%, up from 2.9% just three years ago.

These figures highlight the stark reality that Californians are facing in the current economic climate. Vehicle sales are currently 12% below the 2.03 million sales level seen in 2016 and 2017 during the pre-pandemic economic boom. Home sales have not fared better, plummeting 42% below the peak of 543,000 in 2021, when low mortgage rates and a demand for larger living spaces drove purchases.

John Sackrison, executive director of the Orange County Auto Dealers Association, attributes the sluggish sales to pandemic-induced supply chain challenges. “Uncertainty tends to make consumers pull back,” Sackrison stated. While manufacturers are attempting to stimulate sales with incentives for slow-moving models, the overall sentiment remains cautious.

This trend isn’t isolated to California. Nationally, vehicle sales are projected at 16.3 million annually in 2025, down 3% year-over-year. Homebuyers across the U.S. are also showing reluctance, with purchases dropping to a pace of 4 million annually, a 2% decrease compared to 2024.

With economic pressures mounting, California’s consumers are adopting a wait-and-see approach. The focus now shifts to how these trends will influence the broader economic landscape and whether any measures will be taken to bolster confidence among shoppers. As the situation develops, Californians are left wondering when, or if, they will feel comfortable making significant purchases again.

Stay tuned for the latest updates on this unfolding story.