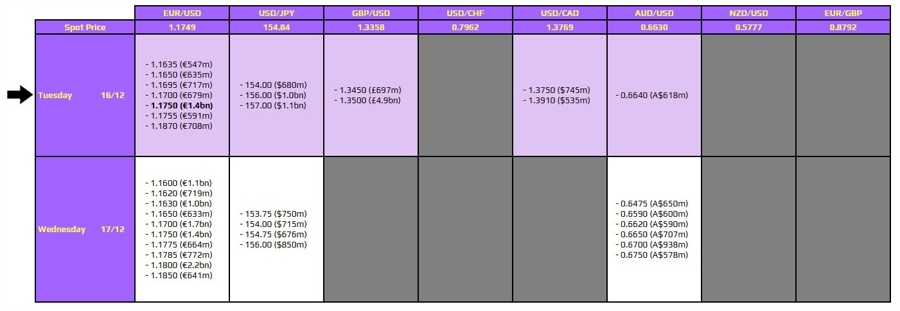

The foreign exchange market is poised for potential fluctuations as notable options expiries are set for December 16, 2023, at 10:00 AM New York time. Specifically, the expiry for the EUR/USD currency pair at the 1.1750 level has gained attention. While these expiries do not hold direct technical significance, they may influence price movements in the market, especially ahead of key economic data releases later in the day.

Market Dynamics Ahead of Economic Announcements

Traders are advised to monitor the EUR/USD expiry closely, as it could act as a price magnet, drawing attention before the release of crucial US economic indicators. The day will feature important data including the US jobs report and retail sales figures, which are likely to have a significant impact on market dynamics.

In the lead-up to these announcements, the Euro area Purchasing Managers’ Index (PMI) data could also contribute to market activity during European trading hours. While this data may not elicit dramatic shifts, it is expected to keep the atmosphere lively. However, barring unexpected developments, the EUR/USD pair may experience subdued trading activity until the US data is made public.

Market participants are encouraged to stay informed about these developments to navigate potential volatility. For a deeper understanding of how to leverage this data in trading strategies, individuals can refer to specialized financial platforms such as InvestingLive.

The unfolding events on December 16 will be closely watched by traders across the globe as they seek to capitalize on possible price movements linked to the EUR/USD expiry and forthcoming economic reports.