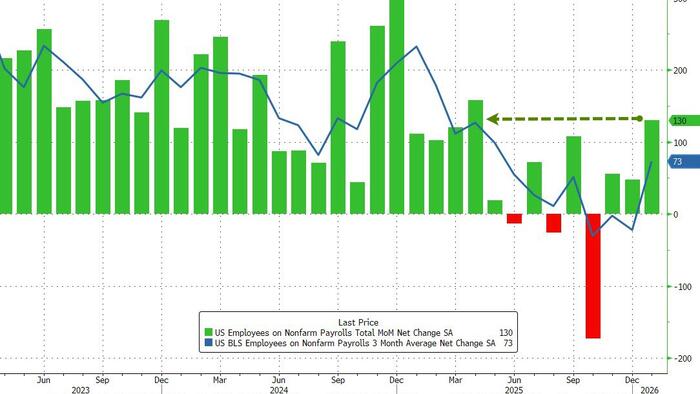

Financial markets experienced a sharp downturn on October 1, 2023, following an announcement from the Chair of the Federal Reserve, Jerome Powell. The central bank revealed that it had received grand jury subpoenas, raising concerns among investors about potential legal ramifications and their impact on monetary policy.

The news sent waves through various sectors, with the Dow Jones Industrial Average falling by over 200 points in early trading. Analysts noted that the subpoenas could indicate increased scrutiny of the Federal Reserve’s actions during a period of significant economic volatility. The central bank has been pivotal in shaping monetary policy in response to inflation and economic recovery efforts.

As investors digested the implications of this announcement, concerns about transparency and accountability within the Federal Reserve grew. The subpoenas are part of an investigation that could probe the decision-making processes of the bank, potentially involving its response to inflation and interest rate adjustments.

Market Response and Economic Implications

The reaction from financial markets was immediate and pronounced. Major stock indices fell sharply, reflecting investor anxiety. The S&P 500 index dropped by approximately 1.5%, while technology stocks, often more sensitive to regulatory news, saw a decline of nearly 2%.

Economists suggest that the legal scrutiny could lead to a more cautious approach from the Federal Reserve as it navigates its monetary policy strategies. John Smith, a financial analyst at XYZ Investment Group, noted, “Investors are concerned about the implications of these subpoenas. The Fed’s credibility is at stake, and any misstep could further shake market confidence.”

The timing of this news is critical, as the Federal Reserve is scheduled to meet later this month to discuss interest rates. Analysts are now speculating on whether the subpoenas will influence the Fed’s decisions regarding rate hikes, which have been a contentious topic among investors.

Looking Ahead: What This Means for the Federal Reserve

The Federal Reserve’s ability to maintain independence while under investigation may face significant challenges. The bank’s mandate to manage inflation and support economic growth could be complicated by public perception and legal inquiries.

As the investigation unfolds, it remains uncertain how long the scrutiny will last and what specific actions regulators may take. Legal experts warn that the outcome could have lasting implications for the Federal Reserve’s operations and its relationship with Congress and the public.

Market analysts recommend that investors closely monitor developments related to the subpoenas and any potential fallout. The coming weeks will likely reveal how the Federal Reserve adapts to this unexpected legal hurdle, impacting both the financial markets and broader economic conditions.

In conclusion, the situation surrounding the Federal Reserve’s grand jury subpoenas highlights the complexities of monetary policy in a politically charged environment. As Jerome Powell and his team navigate these challenges, the response from markets will be a key indicator of investor sentiment and economic stability in the United States.