Paramount Global has raised significant concerns regarding Netflix’s proposed acquisition of assets from Warner Bros. Discovery (WBD). The company submitted a letter to lawmakers on March 6, 2024, stating that the deal could be “presumptively unlawful” and would serve to strengthen Netflix’s already dominant position in the streaming video on demand market.

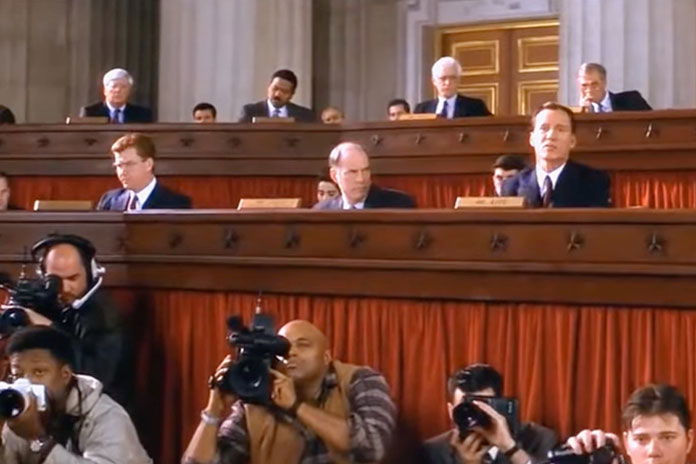

The letter, penned by Paramount’s chief legal officer, Makan Delrahim, was directed to the House Judiciary Antitrust Subcommittee during a pivotal hearing focused on the current state of the streaming industry. According to reports from Deadline, the subcommittee discussed various aspects of the WBD sale, highlighting its potential impact on competition within the sector.

In the communication, Delrahim emphasized that the acquisition could further solidify Netflix’s market power, thereby diminishing competition. Paramount’s action comes in the wake of WBD’s recent agreement with Netflix, which involves the streaming giant purchasing the studio and its associated assets while WBD’s cable channels will be restructured into a separate entity.

The implications of this acquisition may hinge on how the government views Netflix’s role. Should regulators classify Netflix as the leading force in the subscription video on demand (SVOD) market, the concerns raised by Paramount could gain traction. Alternatively, if the focus shifts to viewing Netflix in direct competition with platforms like YouTube or social media channels such as TikTok and Instagram, the regulatory landscape may change.

Paramount’s representatives did not address the subcommittee directly during the hearing, indicating a strategic choice to express their concerns through formal channels rather than in person. This approach suggests a calculated effort to influence legislative opinions regarding the competitive dynamics of the streaming market.

As the situation unfolds, the streaming industry continues to evolve rapidly. The potential repercussions of this deal will not only affect the companies involved but also shape the landscape for consumers and competitors alike. Paramount’s proactive stance highlights the ongoing tensions in a sector marked by significant mergers and acquisitions, as companies vie for dominance in an increasingly crowded marketplace.