Just over a month after its debut on ESPN, WWE’s financial performance regarding Premium Live Events (PLEs) reveals significant challenges. Initially announced in August, the deal secured WWE approximately $325 million annually for five years, with ESPN committing to exclusive broadcasting rights for its events.

A report from the analytics firm Antenna indicates that ESPN Unlimited attracted 2.1 million new subscribers between August 21 and September 30, 2023. These subscribers opted for either a monthly fee of $29.99 or an annual payment of $299.99. Notably, this figure excludes cable bundle subscribers who accessed the app, highlighting the significant reach of the service.

Subscriber Growth and Financial Outlook

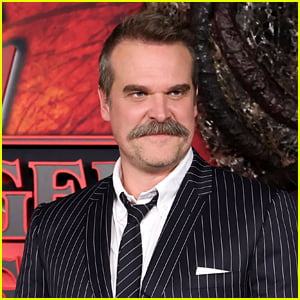

The weekend of Wrestlepalooza, held on September 21, marked a peak in new subscriber sign-ups, accounting for approximately 100,000 to 125,000 of the new ESPN Unlimited memberships. Wrestling Observer Radio’s Dave Meltzer noted that if new subscriptions maintain a similar trend each month, the partnership could yield around $35 million annually for ESPN. This figure stands in stark contrast to the annual payout of $325 million to WWE, raising concerns about the financial viability of the deal in the short term.

Meltzer suggested that while ESPN faces significant losses initially, there is optimism for future growth. The goal is for ESPN Unlimited to eventually secure 50 million subscribers, each contributing $30 per month. Such numbers could transform the financial landscape for the network and enhance the overall profitability of the WWE partnership.

In comparison, the recently launched FOX One direct-to-consumer app reported 1.1 million new subscribers during the same period, indicating a competitive landscape for streaming services in the wrestling domain.

As the partnership evolves, the focus will remain on subscriber retention and the potential for long-term profitability. The initial subscriber surge is promising, but sustaining growth in a saturated market could prove challenging for ESPN and WWE alike.