The deadline of December 15, 2025 for enrolling in health care plans under the Affordable Care Act (ACA) has passed without a resolution on federal subsidies, leaving millions of Americans facing significant healthcare cost increases in 2026. Despite a last-minute effort in the House to extend these subsidies, Congress is set to adjourn for the year on December 19, making it increasingly likely that individuals relying on ACA subsidies will see their health care costs soar.

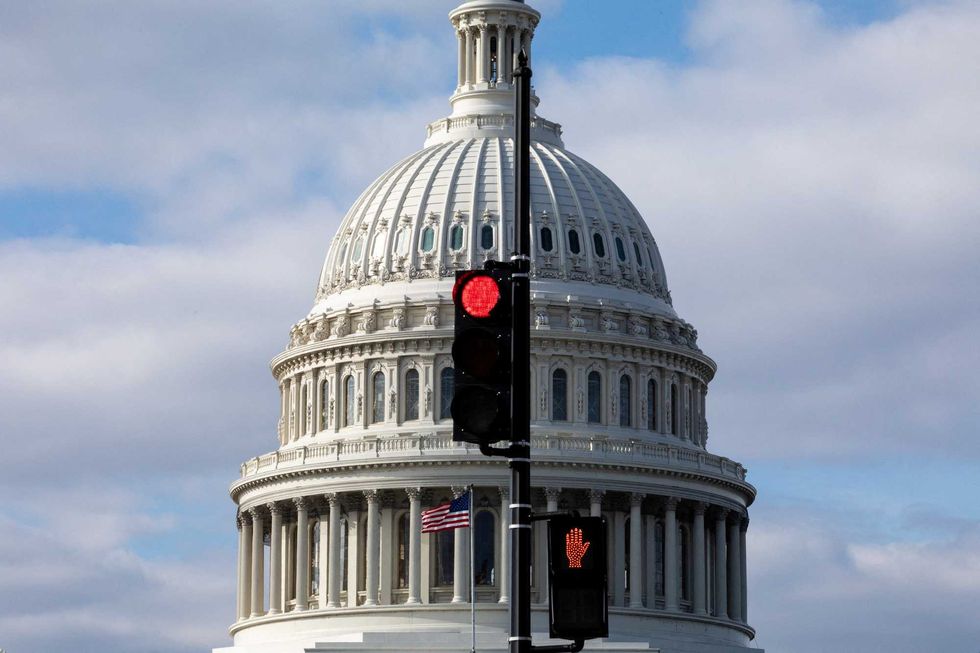

As a gerontologist focused on the U.S. health care system, I understand that the ongoing debate about health care has deep historical roots. The central issue revolves around whether the government should provide health care or if this responsibility lies with individuals and their employers. The ACA, enacted in 2010, marked a pivotal moment in this debate, becoming the first major health legislation since Medicare and Medicaid were established in 1965. The political contention surrounding the ACA has led to significant events, including a record-breaking 43-day government shutdown that started on October 1, 2025.

The ACA’s intention was clear: to reduce the uninsured population by approximately 30 million individuals, dropping the rate to around 3 percent of the U.S. population. While it has made progress, with about 26 million Americans currently uninsured—representing 8 percent of the population—disparities remain, influenced by economic conditions and policy changes.

The Impact of ACA Subsidies on Health Coverage

The ACA introduced various strategies aimed at increasing health coverage, including allowing young adults to remain on their parents’ insurance until the age of 26 and mandating that everyone have health insurance. However, the most significant changes came from expanding the Medicaid program and providing subsidies for low- to moderate-income individuals to purchase health insurance through the marketplace.

Initially mandated for all states, Medicaid expansion faced challenges, and the Supreme Court ruled that states could decide on their participation. As of December 2025, 40 states and the District of Columbia have opted to expand Medicaid, covering about 20 million Americans. Meanwhile, the ACA marketplace subsidies, which assist working individuals who lack employer-provided health insurance, have also evolved.

In 2021, legislation passed under the Biden administration increased these subsidies to counteract the economic fallout from the COVID-19 pandemic. This not only eliminated premiums for the lowest-income individuals but also extended assistance to those earning above the previous threshold. However, these pandemic-era enhancements are set to expire at the end of 2025, which could lead to drastic cost increases for consumers.

If these subsidies revert to their prior levels, individuals earning $45,000 annually could see their monthly health insurance costs rise by 74 percent, from approximately $360 to an estimated monthly payment of $513. Additionally, insurance plan prices themselves are expected to rise by about 18 percent, potentially leading to over a 100 percent increase in costs for many ACA marketplace users. Proponents of extending the pandemic-era subsidies warn that without intervention, as many as 7 million individuals may leave the ACA marketplace, with around 5 million at risk of becoming uninsured in 2026.

Future Challenges in Health Care Coverage

The implications of these changes are significant, particularly as federal policies affecting Medicaid are also being altered. The Congressional Budget Office estimates that recent cuts to Medicaid could result in more than 7 million individuals losing their coverage, with the total number of uninsured Americans potentially reaching 16 million by 2034. This scenario would undermine much of the progress made since the ACA’s implementation.

Criticism of the ACA subsidies has risen, particularly regarding their costs to the federal government. From 2021 to 2024, the number of individuals receiving subsidies doubled, leading to increased federal expenditures. In 2025, nearly 22 million Americans received assistance, a substantial increase from 9.2 million in 2020. Critics argue that this funding supports high earners who may not require government assistance, and that temporary measures should not lead to permanent policy changes.

Additionally, the ACA has impacted employer-provided health insurance significantly. While companies with over 50 employees are required to offer health coverage, smaller employers have seen a decrease in their responsibility, with only 64 percent of businesses with 25 to 49 workers offering health insurance by 2025, down from 92 percent in 2010.

As the U.S. grapples with the most expensive health care system globally, the projected rise in uninsured individuals threatens to escalate costs further, as fewer people engage in preventive care. The disparity in uninsured rates across states, from 3 percent in Massachusetts to 18.6 percent in Texas, reflects the varying political landscapes that shape health policies.

The ongoing debate over health care responsibility remains unresolved. Advocates for government involvement argue for expanded coverage financed through taxes, while those favoring individual responsibility promote market-driven solutions. Until lawmakers address the fundamental question of health care financing, the U.S. may continue to face a polarized health care landscape for years to come.