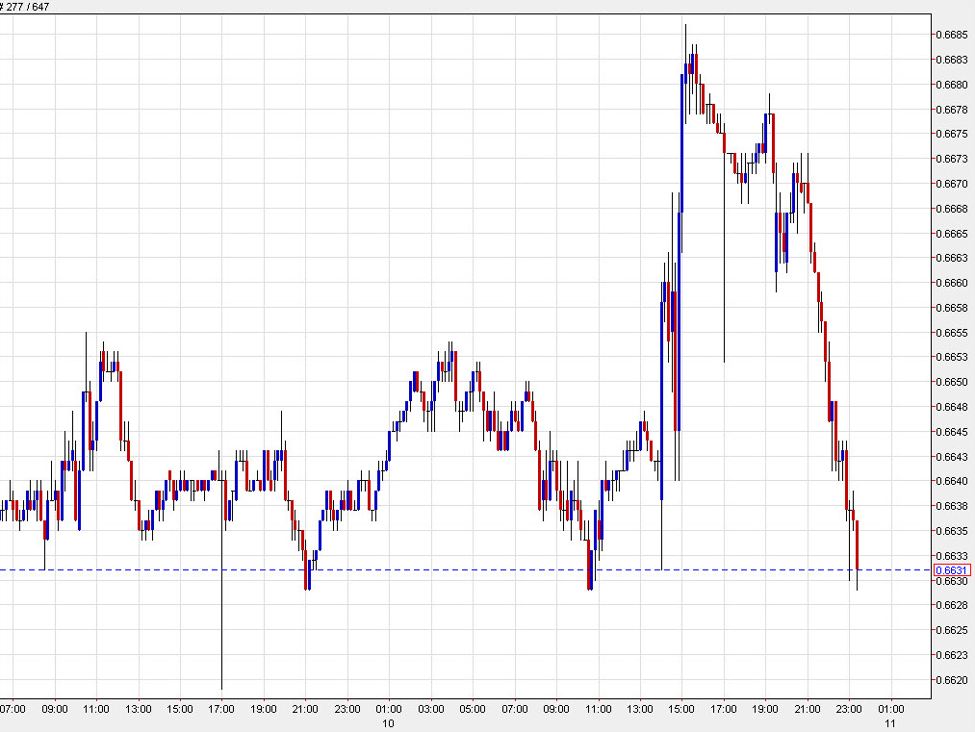

URGENT UPDATE: The Australian dollar (AUD) is experiencing a significant decline in Asia today, unwinding gains made following the U.S. Federal Reserve’s recent announcement. As of October 12, 2023, the AUD/USD pair is retreating, mirroring a broader market trend that has left investors scrambling for clarity.

The initial optimism following the Fed’s decision has quickly faded. Traders attempted to push the AUD higher, but momentum waned, leading to profit-taking across the board. This downturn has been exacerbated by a disappointing performance from Oracle, whose shares plummeted after their earnings report, contributing to heightened market anxiety.

In a silver lining for the AUD, the Federal Reserve has revised its GDP growth forecast for 2026 upwards to 2.3%, up from 1.8%. This adjustment signals potential growth in global markets, which is crucial for Australian commodity exports. However, this positive outlook is tempered by ongoing struggles within the Chinese stock market, leading to diminished confidence in Australia’s economic recovery.

Market analysts suggest that the current volatility may persist until more substantial economic developments emerge. The sentiment is that traders will need to wait for a more significant catalyst than the Fed’s forecast to shift the market dynamics decisively.

As of now, the focus remains on the AUD/USD, with investors keen to see whether external factors will provide a much-needed boost or if the decline will continue. The market’s immediate outlook is uncertain, and traders are advised to remain vigilant.

In summary, the Australian dollar is facing headwinds as it retracts from earlier gains, driven by profit-taking and external market pressures. The economy’s future hinges on key developments ahead, particularly regarding global growth and commodity demand.

Stay tuned for further updates as this situation evolves.