UPDATE: A groundbreaking report reveals that China’s global lending portfolio has surged to an astonishing $2.1 trillion, reshaping the landscape of international finance. This urgent finding from the Virginia-based research institute AidData highlights the dramatic extent of China’s influence, challenging long-held perceptions about its lending practices.

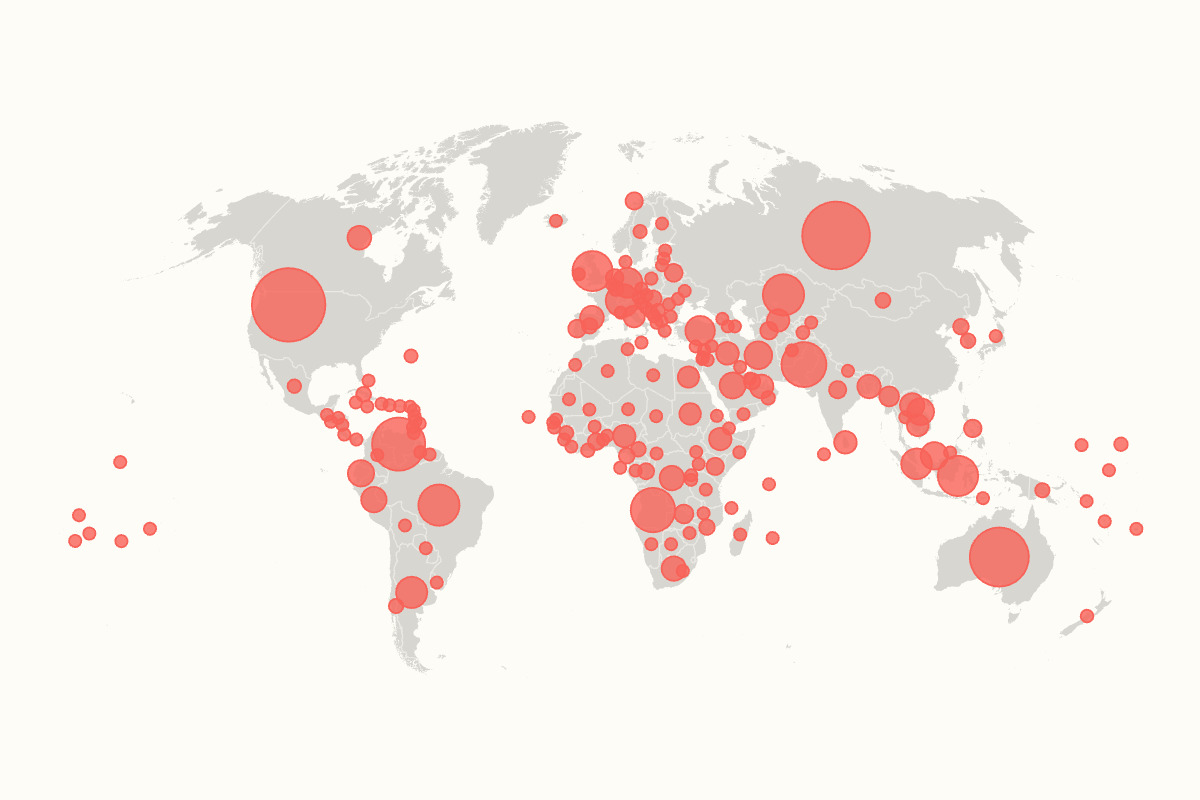

The report, based on a comprehensive three-year study tracking 30,000 projects across 217 countries, illustrates that China’s role as the world’s largest creditor is now firmly established. This status has enabled Beijing to enhance its diplomatic leverage, often outpacing the United States in strategic resource acquisition.

Among the most significant revelations is that high- and upper-middle-income nations account for a staggering 76 percent of these loans. This contradicts previous assumptions that China’s lending primarily targeted developing countries. Notably, the United States tops the list of recipients, with $202 billion in loans spread across 2,500 projects nationwide.

Following the U.S. is Russia, a key strategic partner, receiving $172 billion, and Australia, which is burdened with $130 billion in loans. Other major recipients include Venezuela and Pakistan, at $105.7 billion and $75.6 billion respectively. The United Kingdom rounds out the top ten with significant obligations.

Critics, including U.S. officials, have long accused China of engaging in “debt-trap diplomacy,” a tactic that purportedly leads to financial distress among borrowing nations. However, Chinese officials have strongly rejected this narrative, asserting that their international lending is based on mutually beneficial principles.

Brad Parks, executive director of AidData, stated, “This is an extraordinary discovery given that the U.S. has spent the better part of the last decade warning other countries of the dangers of accumulating significant debt exposure to China.” Meanwhile, Yang Baorong, a prominent Chinese academic, emphasized that China’s financing strategies prioritize infrastructure and capacity-building aimed at fostering self-reliance.

The implications of this report are profound. The authors argue that China is emerging as a “new global pace-setter,” compelling traditional lenders such as the U.S., Germany, and Japan to reevaluate their aid and credit strategies. As Washington and its allies grapple with this shifting financial dynamic, the urgency for a strategic response grows increasingly critical.

As this story continues to develop, the global community will be watching closely to see how nations adapt to China’s expanding financial influence. Will traditional lenders pivot their strategies to counter China’s growing dominance in international finance? Only time will tell.

Stay tuned for more urgent updates on this evolving situation as the world navigates the implications of China’s unprecedented lending practices.