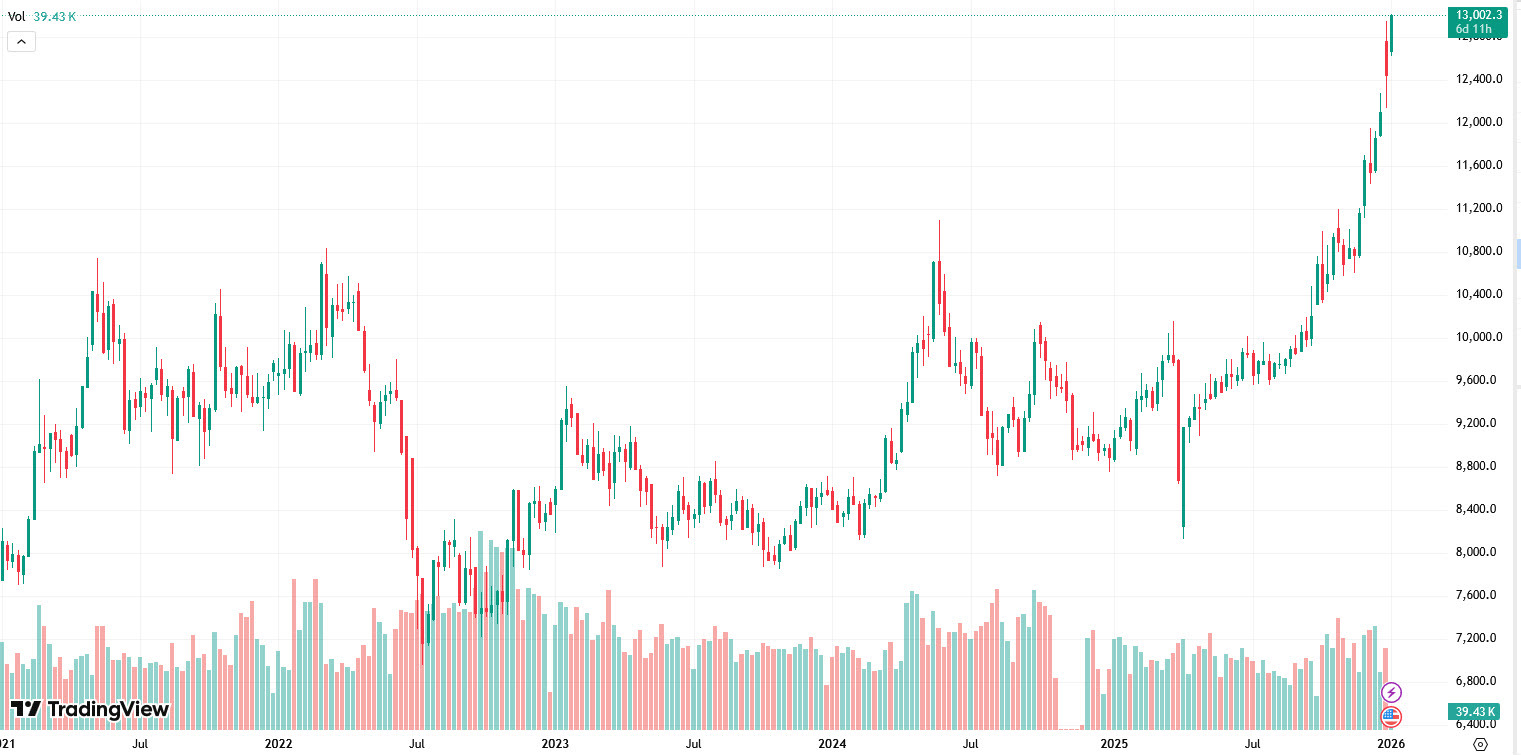

UPDATE: Copper prices hit an unprecedented $13,000 per ton today, marking a significant milestone in the market that traders have been anticipating. This surge is fueled by ongoing supply disruptions, including a critical strike at Capstone Copper’s Mantoverde mine in the Atacama region of Chile.

The strike, initiated by Union #2, has resulted in a workforce reduction of approximately 50%, leaving the mine operating at just 30% capacity. The strike follows failed mediation efforts and could further exacerbate the already tumultuous supply situation, especially as the Grasberg mine also faces ongoing operational challenges due to last year’s catastrophic mudslide.

Analysts predict that the strike at Mantoverde could result in a loss of 29,000 to 32,000 tons of copper production for the affected period. This comes at a time when the market is particularly sensitive to supply shocks, with the Grasberg mine forecasted to be offline for approximately 270,000 tons throughout the year.

While Mantoverde may not rival the scale of Grasberg or Escondida, the loss of any supply is significant in a tightening market. The situation is compounded by labor unrest across the industry, as five separate union contracts are set to expire at Chile’s state-run Codelco this year, leading to heightened tensions and potential further strikes.

As the market reacts to these developments, traders are closely monitoring negotiations at Centinela and the upcoming discussions at Anglo American’s Los Bronces. The overall landscape suggests a growing demand for higher wages and improved safety conditions, which could lead to more disruptions.

The technical indicators show no barriers to further price increases, with projections suggesting that copper could reach upwards of $16,000 per ton within the 2022-2025 range.

With the copper market in a state of flux, all eyes are on the ongoing strike and its potential ripple effects on global supply chains. Investors and stakeholders are urged to stay alert as these developments unfold, signifying a critical moment in the copper trade.